A few weekends ago, I went with my wife to a conference sponsored by Americans for the Arts in Sundance Utah. My main reason for being there was to accompany her and enjoy the resort. I learned some things there too. In talking with other arts administrators from around the country, I realized how important knowledge and appreciation for the arts is for all students regardless of their major. Something I experienced when I was in college.

As an undergraduate engineering student, I had to have 223 quarter hours to complete my degree. Only three of these were for a free elective. I took the easiest sounding course I could find – music appreciation. It wasn’t what it sounded like at all! Our teacher started with the Gregorian Chants from 900 AD and went right up to the present day popular music at that time including the classics. She really challenged us. I took the time to study and learn to appreciate all the music we listened to. In addition to passing the course, I developed an appreciation for classical music I still have today. We are subscribers to the Baltimore Symphony and go at least three or four times a season. I have thanked my teacher many times for helping me learn and appreciate the arts. Science, technology, engineering and mathematics (STEM) are all very important areas of study but no student’s education is complete without developing an appreciation for the arts. It’s STEAM not STEM. The arts are important too.

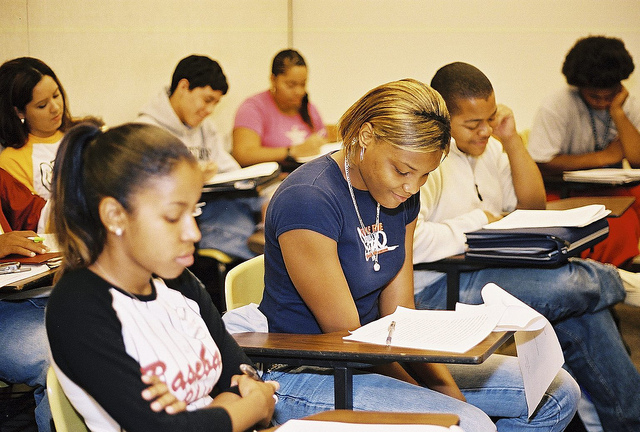

The focus for this fall’s college freshmen has, no doubt, been academic preparation to be accepted into their chosen college or university and to do well once they arrive. There’s another important aspect of preparation for college that may not have gotten enough attention – financial preparation. I don’t mean having enough money to pay for college even though that’s a tremendous challenge. I’m referring to money college students will spend for other things. Parents can’t send them everything they need or want. The question is whether they’ll know how to manage the hundreds or thousands of dollars they spend in cash and with debit/credit cards during the school year whether they earn it or get it from home.

The focus for this fall’s college freshmen has, no doubt, been academic preparation to be accepted into their chosen college or university and to do well once they arrive. There’s another important aspect of preparation for college that may not have gotten enough attention – financial preparation. I don’t mean having enough money to pay for college even though that’s a tremendous challenge. I’m referring to money college students will spend for other things. Parents can’t send them everything they need or want. The question is whether they’ll know how to manage the hundreds or thousands of dollars they spend in cash and with debit/credit cards during the school year whether they earn it or get it from home. Picture this in your mind. World class athletes line up for a 100-yard dash. All of them are white except one who is Black. When the gun sounds the white athletes bolt from their starting blocks and run as fast as they can. The black runner, however, is held back until the other runners have gone 50 yards. Then he is allowed to run and told “you’re equal now”. When he asks about the 50-yard head start everyone else got, he’s told to make that up “on your own”. That’s where we are in America since affirmative action programs have be eliminated in colleges and universities. Although past racial injustices have not been addressed, blacks and other persons of color have been told to make up the huge gaps that remain “on their own”. In a

Picture this in your mind. World class athletes line up for a 100-yard dash. All of them are white except one who is Black. When the gun sounds the white athletes bolt from their starting blocks and run as fast as they can. The black runner, however, is held back until the other runners have gone 50 yards. Then he is allowed to run and told “you’re equal now”. When he asks about the 50-yard head start everyone else got, he’s told to make that up “on your own”. That’s where we are in America since affirmative action programs have be eliminated in colleges and universities. Although past racial injustices have not been addressed, blacks and other persons of color have been told to make up the huge gaps that remain “on their own”. In a

Several states offer free tuition programs for students to attend state colleges and universities. The programs require various qualifiers including but not limited to state residency, maximum income cutoff, community service or attendance requirements and/or a minimum 2.5 grade point average in high school. All programs also require parents and students to fill out the

Several states offer free tuition programs for students to attend state colleges and universities. The programs require various qualifiers including but not limited to state residency, maximum income cutoff, community service or attendance requirements and/or a minimum 2.5 grade point average in high school. All programs also require parents and students to fill out the