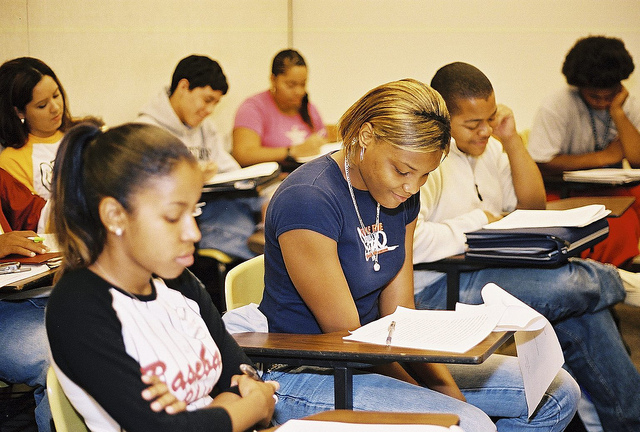

The focus for this fall’s college freshmen has, no doubt, been academic preparation to be accepted into their chosen college or university and to do well once they arrive. There’s another important aspect of preparation for college that may not have gotten enough attention – financial preparation. I don’t mean having enough money to pay for college even though that’s a tremendous challenge. I’m referring to money college students will spend for other things. Parents can’t send them everything they need or want. The question is whether they’ll know how to manage the hundreds or thousands of dollars they spend in cash and with debit/credit cards during the school year whether they earn it or get it from home.

The focus for this fall’s college freshmen has, no doubt, been academic preparation to be accepted into their chosen college or university and to do well once they arrive. There’s another important aspect of preparation for college that may not have gotten enough attention – financial preparation. I don’t mean having enough money to pay for college even though that’s a tremendous challenge. I’m referring to money college students will spend for other things. Parents can’t send them everything they need or want. The question is whether they’ll know how to manage the hundreds or thousands of dollars they spend in cash and with debit/credit cards during the school year whether they earn it or get it from home.

Parents, start teaching your college bound sons and daughters good money management skills before they graduate from high school. We all know how challenging managing money is even if we know how to do it. Every month, things happen that can derail our financial plans. We’ve had time to learn how to deal with these events. Typically, college bound high school seniors haven’t.

Help your sons and daughters practice good money management skills before they go to college also. Knowing how to manage money and doing it well are not the same. Help them get some practice at budgeting and spending their money based on their budget. Also, strongly suggest that they take a course in personal finance to learn more about how to manage money now and after graduation. Take a look at this article to read about four things you can do now so your sons and daughters pass Freshman Finance 101 with flying colors and dollars to spare.

Picture this in your mind. World class athletes line up for a 100-yard dash. All of them are white except one who is Black. When the gun sounds the white athletes bolt from their starting blocks and run as fast as they can. The black runner, however, is held back until the other runners have gone 50 yards. Then he is allowed to run and told “you’re equal now”. When he asks about the 50-yard head start everyone else got, he’s told to make that up “on your own”. That’s where we are in America since affirmative action programs have be eliminated in colleges and universities. Although past racial injustices have not been addressed, blacks and other persons of color have been told to make up the huge gaps that remain “on their own”. In a

Picture this in your mind. World class athletes line up for a 100-yard dash. All of them are white except one who is Black. When the gun sounds the white athletes bolt from their starting blocks and run as fast as they can. The black runner, however, is held back until the other runners have gone 50 yards. Then he is allowed to run and told “you’re equal now”. When he asks about the 50-yard head start everyone else got, he’s told to make that up “on your own”. That’s where we are in America since affirmative action programs have be eliminated in colleges and universities. Although past racial injustices have not been addressed, blacks and other persons of color have been told to make up the huge gaps that remain “on their own”. In a

I recently read a report done by the Neilsen Corporation on African American consumers in America which they titled

I recently read a report done by the Neilsen Corporation on African American consumers in America which they titled  In today’s Washington Post,

In today’s Washington Post,

In the last post, I talked about how to use your textbook to prepare for and get the most out of your classes. You’re a few weeks into the semester so you’re probably preparing for a test on the material you’ve covered so far – let’s talk about how you prep for that.

In the last post, I talked about how to use your textbook to prepare for and get the most out of your classes. You’re a few weeks into the semester so you’re probably preparing for a test on the material you’ve covered so far – let’s talk about how you prep for that.